Islamic Financial Management General Lecture 2021 on Islamic Social Finance

On Friday, April 9, 2021, the Islamic Financial Management Program organized a general lecture with the theme "Islamic Social Finance: Theory and Practice in Malaysia," held from 8:00 AM to 11:00 AM. The guest speakers for this lecture were Dr. Fuadah Johari, an Associate Professor at the Faculty of Economics and Muamalat, University Sains Islam Malaysia (USIM), and Mr. Azhan Ismail, a Senior Financial Manager at the Zakat Collection Center, Malaysia. The event was moderated by Mr. Rizaldi Yusfiarto, M.M, a lecturer from the Faculty of Islamic Economics and Business at UIN Sunan Kalijaga, and it was conducted via Zoom, with 209 participants.

During the opening remarks, the Dean of the Faculty of Islamic Economics and Business, Dr. Afdawaiza, S.Ag., M.Ag., highlighted the importance of Islamic finance, particularly Zakat, Infaq, Sedekah, and Wakaf (ZISWaf), as a solution to economic challenges, especially during the current pandemic. He discussed the challenges, such as the suboptimal collection of ZISWaf and misconceptions about Zakat, contributing to the underutilization of Islamic financial instruments. The lack of public trust in the management of these instruments also hinders their effectiveness.

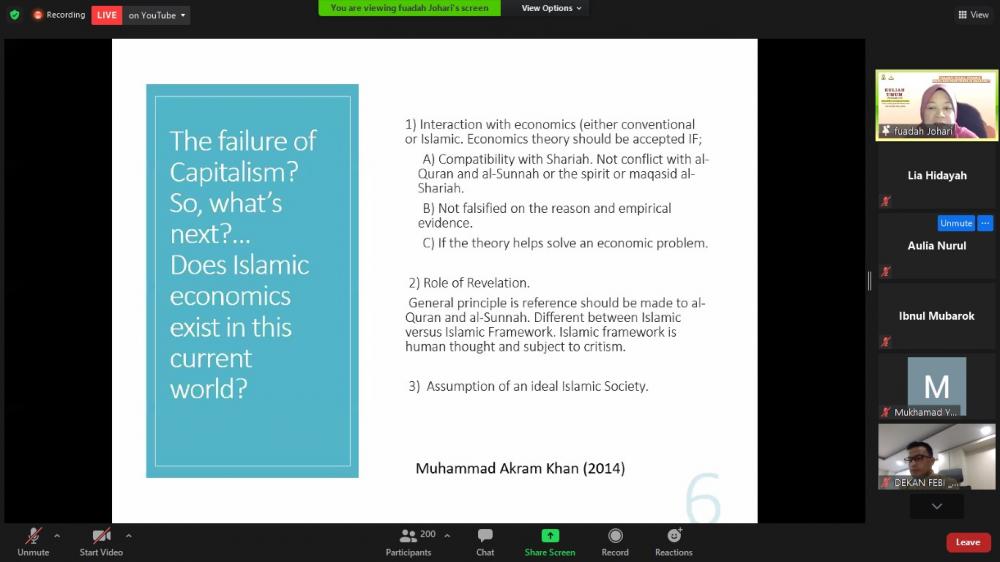

The first speaker, Dr. Fuadah Johari, classified Islamic social finance instruments into traditional and modern categories. Traditional instruments include Zakat, Sedekah, Infaq, and Qard, while modern instruments encompass Sukuk, microfinance, and Takaful, among others.

The second speaker, Mr. Azhan bin Ismail, focused on Zakat as one of the Islamic financial instruments. Islamic Social Finance, incorporating Zakat, Wakaf, Sedekah, and Qard Hasan, aims to assist the community. Other forms include Qard, microfinance, Sukuk, Takaful, and Kafalah. The urgency of Islamic Social Finance lies in minimizing poverty levels in a country. Islamic Social Finance plays a crucial role in achieving the United Nations' Sustainable Development Goals (SDGs), introduced in 2015, which target a 15-year implementation period.

With the advent of the fourth industrial revolution and the advancement of technology worldwide, governments are increasingly adopting financial technology (Fintech) to facilitate financial transactions. Fintech enhances data accessibility for Zakat contributors and recipients, streamlines distribution processes, and improves communication through available technology. The practice of Islamic Social Finance in Malaysia differs from other countries due to its federal system. In Malaysia, each state is responsible for Zakat affairs, overseen by a Sultan. Zakat is paid to a specific institution called the Social Institution. The promotion of Zakat is achieved through education, emphasizing its obligatory nature, and once Zakat is paid, individuals are exempt from paying taxes to the state.

Authors: Aulia Nurul Safitri, Inayah Nadhira Pratiwi